“Give me six hours to chop down a tree, and I’ll spend the first four sharpening the ax.”

-Abraham Lincoln

This timeless piece of advice applies to many situations people encounter in their lives—buying a home is one of them.

If you’re planning on purchasing a home, there are several steps to complete before you slap an offer on the first listing that grabs your attention.

Buying a home isn’t easy.

That’s the truth. And if you’re wondering if you can get ahead of the sale, you can. The earlier you are to the party, the easier it will be to close the deal at a fair price. So what should you be on the lookout for when entering the gauntlet of homebuying?

Start Saving Early

When you’re mapping out the plan to buy a new home, one of the most important preparations you can make is adding to your savings.

Easier said than done, right?

Accumulating wealth begins by making sound financial decisions over time. Here are a few tips to get you on the right track:

1. Prepare meals at home (and shop for generic brands).

2. Cancel subscriptions you’re not using.

3. Eliminate frivolous spending on gambling, alcohol, entertainment, and clothing.

4. Allocate a comfortable amount of your paycheck to go into savings automatically each month.

5. Grow your wealth using risk-averse investments.

6. Pay down and refinance your current debt.

7. Cut back on large purchases.

8. Make a savings goal each month and stick to it.

All of these activities will bring you one step closer to your goal of purchasing a new home. Most people assume the down payment and the closing costs will be their only expenses. However, new homeowners typically buy furniture, make repairs, and enhance their new space to fit their personality.

Getting ahead of your savings as far out as possible can help you avoid financial stressors and give you the flexibility to personalize your new home.

Check and Amend Your Credit

In most cases, having an exceptional credit report will help you secure financing at the lowest rates, which will ultimately save you money. Many websites and banking services offer free credit reports where you can gauge your credit health monthly and respond to any missteps. When preparing to buy a new home, you’ll ideally want a score above 620.

However, there are mortgage options for buyers who don’t have good credit (see below).

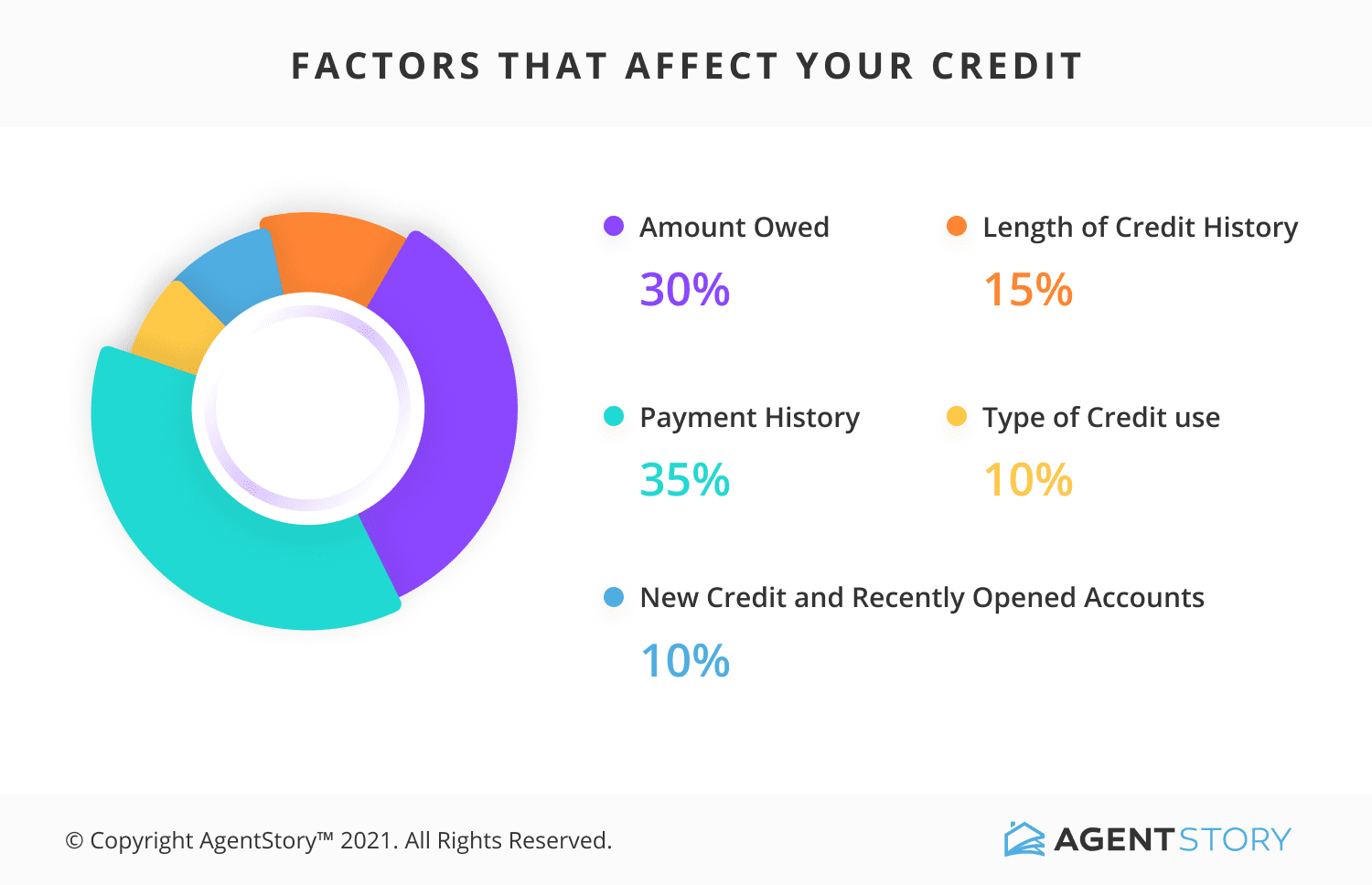

Important factors to consider when amending your credit are the amounts owed, your payment history, and the length of time you’ve held credit. Many first-time homebuyers will experience issues getting a loan because of their “thin” credit history. Unfortunately, there’s not much you can do about this fact (besides having multiple long-standing lines of credit).

Check your credit report for any outstanding debt and pay at least the minimum monthly payments. Continue to make payments on time and try to reduce your overall debt. Reduced debt not only raises your credit score but it lowers your interest payments on those lines of credit as well as your debt-to-income (DTI) ratio.

Determine How Much House You Can Afford

Figuring out how much you should spend on your monthly housing payments isn’t the same for everybody. Your current debt, projected spending, and future plans deserve consideration.

For the risk-averse homeowner:

- Pay down most or all of your debt before buying a home.

- Use your savings to put 10-20% down on your future home (shoot for 20% if using a conventional loan to avoid paying private mortgage insurance, or PMI).

- Use up to 25% of your after-tax income on your monthly mortgage payment.

- Establish an emergency fund before purchasing a home.

Even if you meet a few of these criteria, you’ll be in a better position to avoid financial stressors. There are many other ways to calculate how much to spend on your home, but the premise is simple.

Spend what you’re comfortable with and consult with a financial advisor if you’re unsure.

Create a financial plan and know what you can afford each month; don’t deviate from the program just because you’re itching to buy a home. It’s easy to get wrapped up inside of a beautiful open house or jump at the money your lender is offering you, but it will only cause unnecessary financial stress in the future.

Explore Mortgage Options

Once you’ve entered the home buying arena, shopping for the best mortgage is essential if you’re not buying a home outright. There are various mortgage types, each catering to different consumers. These four are common and will cover most homebuyers:

1. Conventional

If you’re a home buyer with solid credit, consistent employment history, and a sizable down payment, a conventional mortgage could be a good fit. These loans have staunch requirements, unlike other loan types, because the federal government does not back them. This fact makes you riskier to the lender.

Conventional mortgages also incentivize paying your loan down by shedding the mortgage insurance requirement as you increase your home’s equity. If you put 20% down, you can skip paying PMI altogether.

Credit Requirement: Not definitive, but homebuyers should shoot for 680+

Down payment: 3%+

Insurance Needed: Yes, unless you put down 20% of the home’s value as a down payment.

Best for people who have a solid credit rating, can afford a 20% down payment, and who plan on living in their home for a long time.

2. Federal Housing Administration (FHA)

FHA loans promote homeownership in the U.S. by lowering the bar for entry. The credit requirements, down payments, and work tenure are generally lower with these federally-backed loans. However, these loans require the homeowner to purchase PMI, which will make the home more expensive. The FHA requires you to pay for this insurance throughout the life of the loan. Generally speaking, the FHA loan rates are quite good and can even beat the cost of conventional loans.

Credit Requirement: 580+ (there’s no incentive if your credit is higher)

Down payment: 3.5% minimum

Insurance Needed: Yes

Best for homebuyers without great credit scores or a sizable down payment. If you’re planning on living in the home for a short time, it’s an excellent option. PMI on these loans will follow you until the loan is paid off making shorter stays more profitable.

3. Veterans Association (VA)

VA loans are federally-backed loans that allow qualified veterans or surviving spouses to buy homes under favorable conditions. These loans don’t require a down payment or monthly PMI payments. The rates you receive under the VA loan program are usually better than other loan types. However, the VA requires a funding fee for the program, a one-time fee you’ll finance or pay at closing.

Credit Requirement: 620+ (there’s flexibility with this requirement)

Down payment: None required

Insurance Needed: No

Best for qualified veterans or surviving spouses.

4. United States Department of Agriculture (USDA)

Backed by the USDA, these mortgage types provide significant value for homebuyers with low- to moderate-income levels in specific geographic areas. USDA loan benefits include no down/payments, lower PMI costs, and competitive mortgage rates.

Credit Requirement: No set requirement but lenders will typically want 640+

Down payment: None required

Insurance Needed: You’ll pay an “annual guarantee fee,” added to your monthly payment (This fee is usually less expensive than PMI).

Best for qualified homebuyers with low to average income levels looking to buy a home in a rural area.

5. Get Preapproved

After shopping around and finding the right lender, the next step is getting preapproval. The preapproval process is helpful for many reasons because:

- It clarifies the amount you can borrow.

- A preapproval letter shows sellers and real estate agents you’re a serious buyer.

- If you get preapproved, it provides negotiation leverage and gives you flexibility.

- It helps the loan process move faster.

When you’re preparing to buy a home, it’s advantageous to know your borrowing limits. Getting a preapproval letter can speed up the homebuying process and make it easier for the lender, real estate agent, and seller to work with you.

6. Find a Quality Real Estate Agent

The final step of your homebuying preparation is finding the right real estate agent. You’ll want to screen several candidates to ensure they have the skills and experience to find you the right home. Look for an agent who has experience in your local real estate market, excellent communication skills, and a track record of success—especially with your desired home type and price range.

Start by asking friends and family for their agent recommendations. Working with someone familiar can help break the ice. Search for your location and compare agents using the AgentStory agent pages. You can compare each agent’s transaction history, focus data, Areas of Influence, and other important metrics that will help narrow your decision. You can also use this database to learn about real estate agents recommended by friends and family.

Once you’ve found two to five agents who meet your criteria, set up interviews with them. While metrics are important, use interviews to see if you connect personally and professionally. Find out if they’re going to be available when you need them. The right real estate agent will champion your needs, represent you legally, and fight to get the best price for your dream home.

The Bottom Line

Taking the proper precautions before buying a home is a precursor for success. You can receive lower mortgage rates and get a better deal if you improve your credit and save some cash ahead of time. It’s wise to create a detailed monthly budget and get preapproved before searching for the right real estate agent. An agent will help you sift through local market trends and determine the best course of action to find the perfect home.

Being prepared starts with improving your personal financial situation and ends with pulling the right people into your circle. Buying a home is a process that may not take weeks, but even years of preparation for some. Begin as early as possible and ask for help as needed to achieve the best results.